Cyber Security Authority Warns of Rise in Cyberbullying by Digital Lending Mobile Application Owners.

The Cyber Security Authority (CSA) has issued a public alert regarding a significant increase in cyberbullying incidents associated with digital lending mobile applications.

Read more:Ghana Declares June 6, 2025, a Public Holiday in Observance of Eid-Ul-Adha www.noblenew.net.

Between January and May 2024, the CSA received 377 reports, marking a sharp increase compared to the 228 cases reported throughout the entire year 2023.

Read here:MP Condemns Murder of Respected Elder in Ketu North Constituency www.noblenew.net.

According to the CSA, the modus operandi of these fraudsters involves automatically crediting an amount (usually less than GHS 200) into a user’s mobile money wallet without an actual loan request.

Read again:Speaker Bagbin Confirms Reintroduction of Anti-LGBTQ+ Bill.www.noblenews.net.

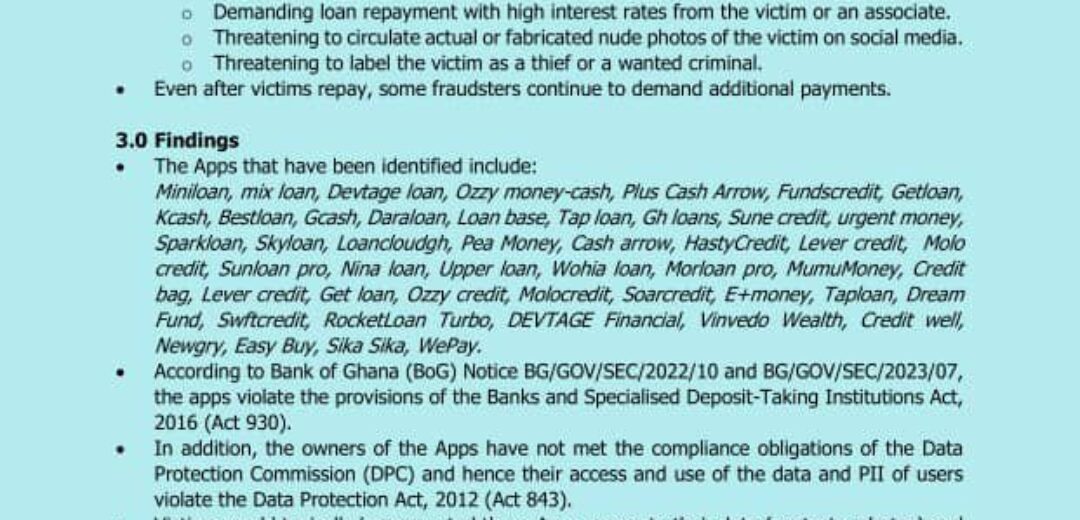

One week after disbursing the loan, the fraudsters use extortion tactics, including demanding loan repayment with high-interest rates, threatening to circulate actual or fabricated nude photos of the victim on social media, and threatening to label the victim as a thief or a wanted criminal.

Even after victims repay, some fraudsters continue to demand additional payments.

The CSA has identified several apps involved in these activities, including Miniloan, mix loan, Devtage loan, Ozzy money-cash, Plus Cash Arrow, Fundscrdit, Getloan, Krash, Bestloan, Grash, Daraloon, Loan base, Tap loan, Gh loans, Sune credit, urgent money, Sparkloan, Skyloan, Loancloudyh, Pea Money, Cash arrow, HastyCredit, Lever credit, Molo credit, Sunloan pro, Nina loan, Upper loan, Wohia loan, Morloan pro, MumuMoney, Credit bag, Lever credit, Get loan, Ozzy credit, Molocredit, Soarcredit, E+money, Taploan, Dream Fund, Swftcredit, RocketLoan, Ozzy Turbo, DEVTAGE Financial, Vinvedo Wealth, Credit well, Newary, Easy Buy, Sika Sika, and WePay.

The CSA has found that these apps violate the provisions of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) and the Data Protection Act, 2012 (Act 843).

The owners of these apps have not met the compliance obligations of the Data Protection Commission (DPC), and their access and use of users’ data and personally identifiable information (PII) violate the Data Protection Act.

The CSA strongly advises the public against subscribing to these mobile applications, as they are not sanctioned by the Bank of Ghana (BoG) or the Data Protection Commission.

Individuals who patronize these services do so at their own risk.

The CSA has a 24-hour Cybersecurity/Cybercrime Incident Reporting Point of Contact (PoC) for reporting cybercrimes and seeking guidance and assistance on online activities.

The contact information is as follows:

– Call or Text: 292

– WhatsApp: 0501603111

– Email: report@csa.gov.gh

The public is urged to be cautious when using digital lending mobile applications and to report any suspicious activities to the CSA.